How To Buy Car Insurance Online

How To Buy Car Insurance Online

The Process of Buying Car Insurance Online

There are three ways you can purchase auto insurance: contacting a company agent, working with an independent broker or buying car insurance online. You can also use a free auto quote tool like ours to help you determine the best car insurance coverage, rate and provider.

Here are some steps to follow to get car insurance online:

1. Get an Online Car Insurance Quote

The first step is to get a quote either through an insurer’s website or by using a free car insurance quote tool like the one below.

To receive your quote, you’ll need to provide the following information:

- Name and address

- Driver’s license number

- Make, model and year of your vehicle

- Vehicle identification number (VIN)

- Descriptions of car accidents, tickets or insurance claims filed in the last several years

2. Compare Quotes

After you provide the necessary information, some sites may offer instant car insurance quotes that allow you to see the cost for the level of coverage you select. Other companies may ask for your telephone number or email address and have an agent contact you with your quotes and options. Reach out to a few companies so you can compare insurance plans.

3. Select Coverage

Insurers that allow you to purchase a policy online will guide you through the purchase process, which should be straightforward. You’ll be asked to select the coverage you want as well as add-on options like roadside assistance, towing or accident forgiveness.

4. Pay

Set up a payment method and input the necessary information. Most insurers may allow you to pay with a credit card, though some will charge a fee for this. Your other option is to pay through a bank by providing your routing number and account information.

5. Print Your Card

Finally, print your insurance card from home. Your insurer may also mail an I.D. card to you.

What To Know When Buying Car Insurance

If you’ve decided that buying auto insurance online is right for you, there are some important things to consider.

Where Can I Buy Car Insurance Online?

Most major auto insurers offer coverage online. Providers that don’t offer online sign-ups and purchases require that you speak to an agent before finalizing your policy. However, most of the purchase process can still be completed on the insurer’s website.

It can take an hour or less if you’re prepared with basic information about yourself, your driving record and your vehicle. An online car insurance policy can go into effect as soon as you make the first payment.

Online Auto Insurance Companies

Here’s a snapshot of which major insurance providers offer car insurance online:

| Car Insurance Company | Online Car Insurance Quotes | Online Car Insurance Purchase |

| Geico | ✓ | ✓ |

| USAA | ✓ | ✓ |

| Progressive | ✓ | ✓ |

| The Hartford | ✓ | ✓ |

| Nationwide | ✓ | ✓ |

| State Farm | ✓ | |

| Liberty Mutual | ✓ | |

| AAA | ✓ | |

| Allstate | ✓ |

How Does Buying Car Insurance Work?

The online insurance purchase process is similar for most companies. If the insurer offers car insurance online, you can get any standard type of coverage you’d need right from your computer or phone. But if you’re looking for specialty auto coverages like classic car insurance, you may have to call an agent to explain your situation.

Types of Car Insurance

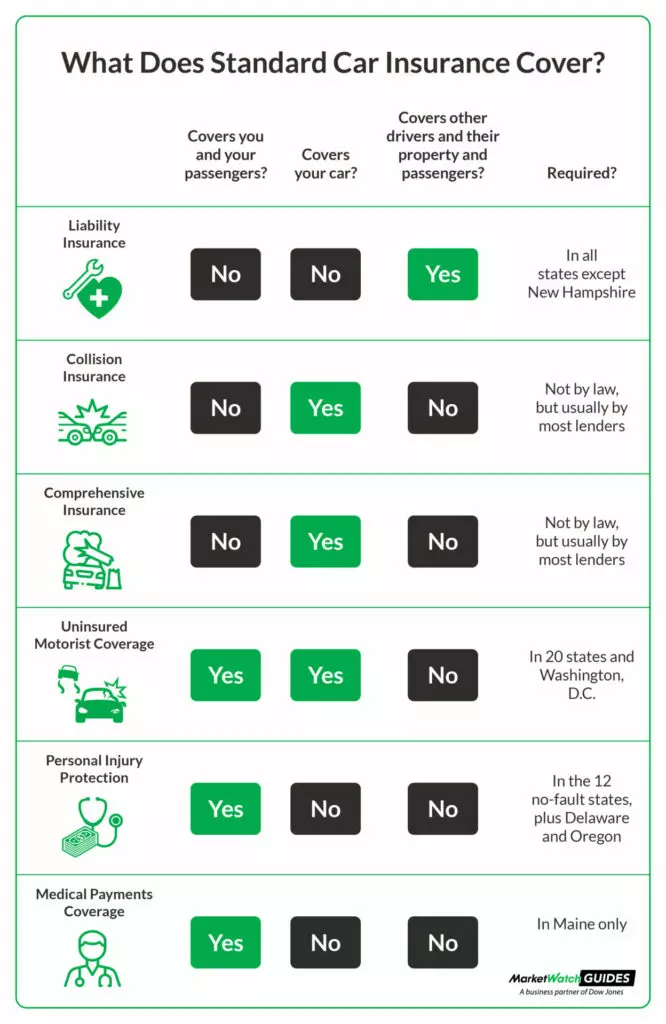

The standard types of car insurance include:

- Bodily injury liability insurance

- Property damage liability coverage

- Underinsured/uninsured motorist coverage

- Medical payments coverage (MedPay)

- Personal injury protection (PIP)

- Comprehensive insurance

- Collision insurance

Liability Insurance

Bodily injury and property damage liability insurance are required in most states (as of July 1, 2024, New Hampshire is the only state that doesn’t require liability coverage). If you’re found at fault for an accident, bodily injury liability will pay the medical bills of the other parties involved. Property damage will pay for repairs to the other parties’ cars. Neither type of liability coverage will pay for your own injuries or car repairs.

Uninsured Motorist and Medical Expense Coverages

Uninsured/underinsured motorist coverage helps with repairs and hospital bills when someone with no insurance or insufficient insurance causes an accident. Medical expense coverages like MedPay and PIP pay for your medical expenses after an accident, with varying regulations for at-fault and no-fault states.

Collision and Comprehensive Insurance

A full-coverage car insurance policy includes both comprehensive coverage and collision coverage. Collision insurance pays for repairs to your vehicle regardless of who caused an accident. Comprehensive coverage protects your vehicle from damages related to the environment:

- Theft

- Vandalism

- Animals

- Fallen objects

- Natural disasters like floods and fire

Take note that auto lenders and leasing companies typically require you to carry a full-coverage policy, but comprehensive and collision coverage are not required by any U.S. state.

Best Way To Buy Auto Insurance

The best way to buy insurance depends on your situation. Car insurance purchased online is usually about the same cost as car insurance purchased through an agent — though you might pay slightly more if you use an insurance broker.

Below are some key differences between buying insurance online versus through an agent:

- Online: If you already know what auto insurance coverage you need, it can be a good idea to purchase car insurance online. Buying online can save time and money. Many of our recommended national providers offer online auto insurance quotes and purchasing.

- Agent: If you aren’t sure what kind of car insurance you need, you may be better off working through an agent. An agent can answer your questions and help you figure out your best coverage options.

Should I Buy Car Insurance Online?

We don’t recommend choosing an insurer based on whether or not you can purchase a policy entirely online. You should choose your insurer based on which company offers the best car insurance rates and coverage for your needs. If that insurer happens to offer online car insurance quotes, you may want to take advantage of it.

It is generally cheaper to buy car insurance online, as there are no agent fees or markups. However, an agent can guide you through the purchase process and help you select the best coverage. Agents may also help you find car insurance discounts you might not otherwise know about.

Either way, research any provider before committing to a policy. Even if you want to work through an insurance agent, it can be a good idea to compare quotes online first. This way, you can get a better feel for the cost of car insurance and which insurers to contact.

Car Insurance Rates Online

According to our rate estimates, full-coverage car insurance costs an average of about $223 per month or $2,681 per year for good drivers. These estimates don’t include policy discounts you may qualify for, such as a homeowners discount or a discount for bundling auto with home insurance, renters insurance or life insurance.

Other common discounts include:

- Teen driver discount

- Safe driving discount

- Good student discount

- Military discount

- Defensive driving course discount

- Safety features discounts

Also, keep in mind that rates change over time. Car insurance premiums can be affected by state regulations, the rate of claims in a location, population growth and more. In our May 2024 car insurance survey, we found that 36% of the 2,000 respondents had experienced a rate increase without an obvious cause.

Cheap Online Car Insurance Companies

Car insurance prices also vary by provider, of course. Here’s how major providers rank based on cost for full-coverage policies:

| Car Insurance Provider | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| USAA | $145 | $1,741 |

| Erie Insurance | $158 | $1,894 |

| Nationwide | $172 | $2,063 |

| Geico | $166 | $1,995 |

| Auto-Owners Insurance | $158 | $1,898 |

| State Farm | $212 | $2,544 |

| Progressive | $194 | $2,326 |

| Travelers | $141 | $1,692 |

| Allstate | $278 | $3,340 |

| Farmers | $291 | $3,495 |

Online Auto Insurance Quotes

Buying coverage online usually involves getting a free car insurance quote online. Quotes are based on a number of factors.

The cost of any auto insurance policy will depend on a number of factors, including your:

- Location: Drivers in places with higher populations and higher rates of accidents or car thefts are more risky to insure, so they’ll often pay more for auto coverage.

- Driving history: Drivers with speeding tickets, accidents or DUIs from the past few years will pay significantly higher rates compared to drivers with clean records.

- Credit score*: Drivers with poor credit scores will pay almost double what drivers with excellent credit pay for auto insurance.

- Vehicle: Sports cars, luxury vehicles or cars with updated technology and safety features often cost more to fix after an accident, so rates are higher for them.

- Age: Drivers under 25 (especially 16-year-olds) often pay more for car insurance because they have less experience behind the wheel.

- Marital status: Married drivers are seen by insurers as more likely to be financially stable, which means they pay less for car insurance compared to single motorists.

- Coverage selection: Adding collision and comprehensive insurance to your policy costs more, but financially protects your car from collisions, theft, vandalism and more.

- Coverage limits: Opting for minimum coverage means much lower car insurance rates, but full coverage protects a driver from paying a lot out of pocket after an accident.

- Deductible: The higher a driver’s deductible is, the cheaper their car insurance is. But, this means they’ll pay more out of pocket after an accident.

*Car insurance companies in California, Hawaii, Massachusetts and Michigan can’t use credit scores to set premiums.

Car Insurance Costs by State

Even if you purchase car insurance online, costs can vary considerably by location. Here are annual and monthly car insurance cost estimates by state.

| State | Monthly Cost Estimate | Annual Cost Estimate |

|---|---|---|

| Alabama | $171 | $2,048 |

| Alaska | $176 | $2,116 |

| Arizona | $261 | $3,127 |

| Arkansas | $200 | $2,398 |

| California | $253 | $3,040 |

| Colorado | $251 | $3,010 |

| Connecticut | $267 | $3,206 |

| Delaware | $280 | $3,364 |

| District of Columbia | $220 | $2,636 |

| Florida | $316 | $3,795 |

The Bottom Line: Purchasing Auto Insurance Online

It’s easier than ever to compare car insurance quotes and buy auto coverage online. You may want to buy through an agent if you aren’t sure what type of coverage you need or what discounts you may qualify for. Otherwise, it’s tough to beat the convenience of buying auto insurance online.

Buy Car Insurance Online

Whether you’re buying car insurance online or in person, it’s important to compare several options so you find the best rates. Use the tool below to compare online car insurance quotes from top companies in your area, or read on to learn more about three of our recommended providers: State Farm, Geico and USAA.

State Farm: Best Customer Experience

State Farm earns our Best Customer Experience award for its extensive coverage options, affordable rates and excellent customer service. Drive Safe & Save™, the company’s usage-based program, offers a sign-up bonus and can save good drivers up to 30% on their premiums upon policy renewal.

Along with what standard auto insurance covers, State Farm offers optional protection like:

- Roadside assistance

- Rental car reimbursement

- Travel expenses

- Rideshare insurance

In our 2024 car insurance survey, about 21% of respondents had State Farm auto coverage. About 88% of these customers reported being satisfied or very satisfied with their car insurance.

Keep reading: State Farm Insurance Review

Geico: Best for Budget Conscious-Drivers

In our industry-wide review, we rated Geico among the top car insurance providers in the country. Geico policies can be purchased online and are often the cheapest car insurance option for drivers. Discounts like those for being a good driver (up to 26% off), being a good student (up to 15% off) and having multiple vehicles on your policy (up to 25% off) are only a few of the ways to save with Geico.

In addition to standard car insurance coverage, Geico offers add-on policy options such as:

- Emergency roadside assistance

- Rental reimbursement

- Mechanical breakdown insurance (MBI)

- Rideshare insurance

About 12% of the respondents in our car insurance survey had coverage through Geico. Around 85% of these Geico customers said they were either satisfied or very satisfied with their coverage.

Keep reading: Geico Insurance Review

USAA: Best for Military Members

To be eligible for a car insurance policy with USAA, you must be a member or veteran of the United States military or have a family member or spouse that is a USAA member. If you are eligible, you can purchase a USAA policy entirely online.

In addition to standard insurance coverages, USAA customers can purchase:

- Roadside assistance

- Rental car reimbursement

- Accident forgiveness

- Glass coverage

- Guaranteed asset protection (Gap)

- Car replacement assistance (CRA)

- Rideshare insurance

Comments

Post a Comment